Making Tax Digital’ (MTD) is an initiative from HMRC. It was first announced in 2015 as part of plans to reform and modernise the tax system in the UK. It should make managing financials easier for both individuals and businesses by introducing a new online tax system, providing users with a personalised tax account containing the latest relevant information.

The initiative will come into effect in the first half of 2019, and is compulsory for all VAT registered businesses with a turnover above the VAT threshold (£85,000).

Making Tax Digital for VAT Timeline

What is happening by when?

October 2018

Open to sole traders and companies (except those which are part of a VAT group or VAT Division) provided they are up to date with their VAT. Those who trade with the EU, are based overseas, submit annually, make payments on account, use the VAT Flat Rate Scheme, and those newly registered for VAT that have not previously submitted a VAT return, are unable to join at this point. Those customers with a default surcharge within the last 24 months will be able to join the pilot by the end of October 2018.

Late 2018

Private testing begins with partnerships and those customers that trade with the EU.

Late 2018 – Early 2019

Open to other sole traders and companies who are not up to date with their VAT, users of the Flat Rate Scheme and businesses newly registered for VAT that have not previously submitted a VAT return.

Early 2019

Open to partnerships and those customers that trade with the EU.

Spring 2019

Pilot open for Making Tax Digital customers that have been deferred.

April 2019

KEY DATE: Making Tax Digital mandated for all customers (except those that have been deferred).

October 2019

Making Tax Digital mandated for customers that have been deferred. The 6-month deferral applies to customers who fall into one of the following categories: trusts, ‘not for profit’ organisations that are not set up as a company, VAT divisions, VAT groups, those public sector entities required to provide additional information on their VAT return (Government departments, NHS Trusts), local authorities, public corporations, traders based overseas, those required to make payments on account and annual accounting scheme users. The deferral will apply to around 3.5% of mandated customers.

HOW WILL MAKING TAX DIGITAL AFFECT YOUR BUSINESSES?

From April 2019, MTD will apply to any business registered for VAT earning above the threshold of £85,000.

By April 2019, businesses need to:

- Keep digital records for VAT purposes

- Provide VAT return information to HMRC through MTD compatible software, not through the online portal

HMRC has said that it won’t provide software for organisations, and business will have to have their own solutions. All Microsoft Dynamics solutions, already store digital records for each transaction. To make this MTD compliant, your system will need to utilize an Application Programme Interface (API) that digitally links HMRC and electronic records.

Although possible you will incur costs during the transition (due to new software implementation and user training), the reduction in errors and administrative overhead after the initial period could mean your business saves money, and increases profits longer term.

HOW IS MICROSOFT SUPPORTING MAKING TAX DIGITAL?

Microsoft confirmed that their SMB accounting software will comply with the initiative when it comes into effect in April 2019, at least in versions with mainstream support. Microsoft Dynamics solutions already submit VAT reports electronically but, as technical requirements are unclear, Microsoft have said they have been working with HMRC throughout 2018 to “ensure that our all-in-one business management solutions Dynamics 365 Business Central and Dynamics NAV support Making Tax Digital.” HMRC has a list of software products that are compatible with Making Tax Digital and Dynamics 365 Business Central and Dynamics NAV have made that list.

The new features should be available for release soon, Dynamics 365 Senior Programme Manager Søren Friis Alexandersen writes on LinkedIn.

WHAT ARE THE NEW FEATURES?

HMRC makes it possible for a system like Dynamics 365 Business Central to get access to your company’s VAT obligations through HMRC systems in a secure manner. These are retrieved and stored inside the system under the name “VAT Return Periods”. This lets you know about current VAT obligations, which period should be reported and when. Having this VAT obligation in the system allows for an easy one-click creation of a VAT return. The user can also be reminded when to submit the VAT return, as the due date is included.

After the VAT return is created, through standard functionality, Dynamics 365 Business Central can calculate the numbers to report in the return. The system will suggest to calculate VAT based on the period retrieved from HMRC, leaving few things for the user to worry about. Submitting the VAT return is an easy one-click operation, and a receipt is displayed instantly.

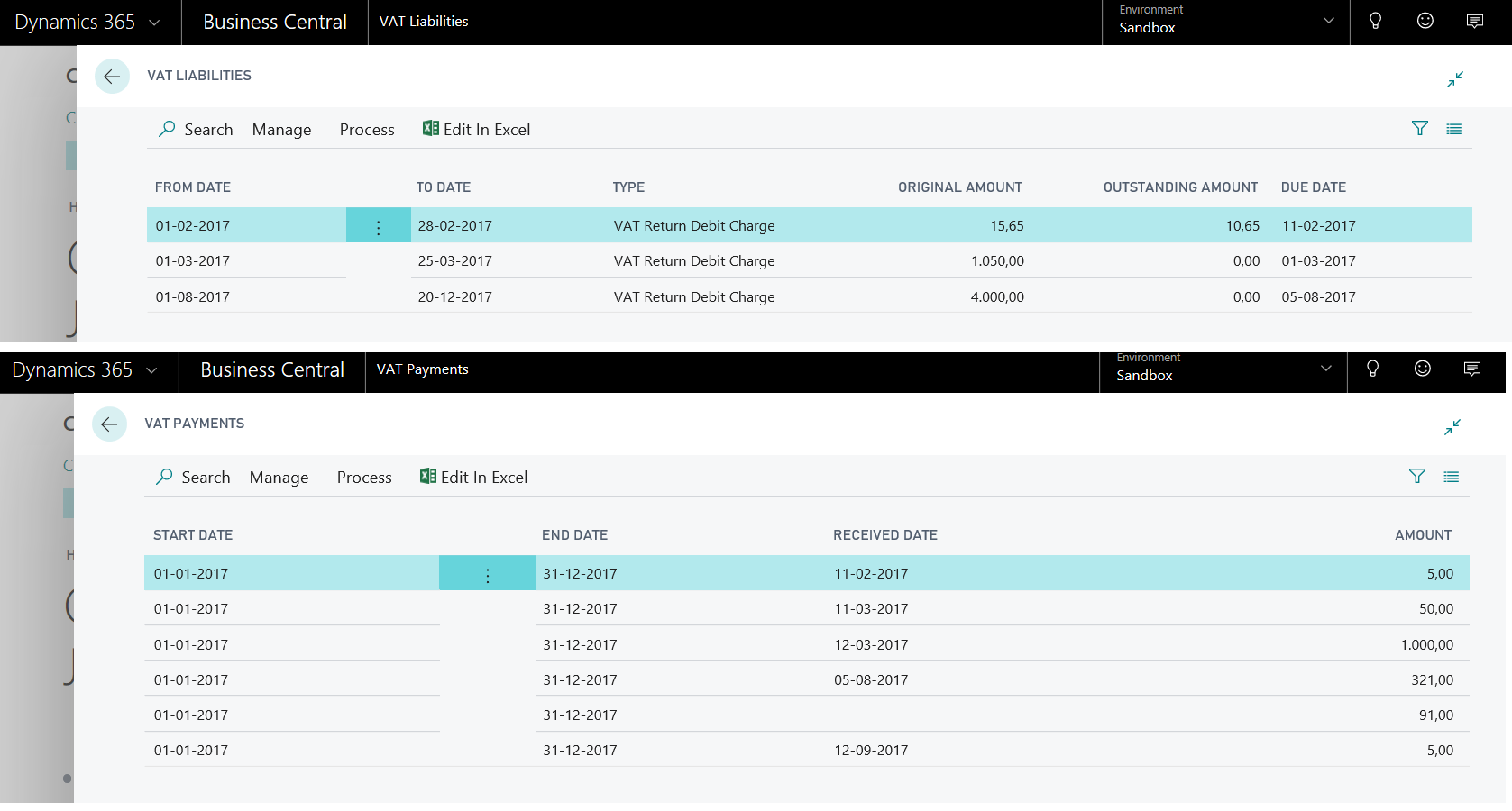

HMRC is also making VAT liabilities retrievable through APIs. These are gathered so you can view them inside Dynamics 365 Business central, to easily get an overview of your VAT payment status with HMRC.

Be sure to keep Up2Date with Connamix news to make sure you don’t miss out on the latest information about Making Tax Digital, other transformations and updates to ERP software.